A long-time gamer and now heading Unikrn’s expansion programs, Justin Dellario speaks his mind on the future and direction of the esports industry.

Being a part of the esports industry back when the industry was not even known as esports, Justin Dellario has donned many hats over the course of his career. Coming from a military background, Justin has worked as an entrepreneur as well as held day jobs for companies such as Razer and Twitch. He was responsible for starting Twitch Rivals one of the most popular online esports tournaments on the Amazon-owned platform. After Twitch he made the transition to the Entain Group and is now the Managing Director of esports.

Esports betting platform, Unikrn, made a return last December with a new website and under new ownership. We spoke to Justin Dellario, CEO of Unikrn on his thoughts about the esports industry heading into 2023.

Rohan Samal: Hi Justin, it’s great to meet you. You have been involved in esports for a very long time. How did you get into esports and what are some of your earliest memories in this industry?

Justin Dellario: I was always a competitive gamer growing up. More than just playing a lot of different games, I was one of the people that was in the category of always wanted to know if I was better than somebody else. When games started making actual online ladders and I found out about the existence of these tournaments - places where people were proving just that - how good they are compared to other people, I was instantly drawn to it.

Esports wasn't the first part of my career. I had a day job in the military in the government but I was drawn to the first iteration of Major League Gaming or Smash Brothers tournaments. I found out they were happening near where I live. That solely progressed to getting together with like-minded individuals and getting involved in the creation of tournaments, and online communities around esports. We didn't call it esports at the time, it was called 'Pro gaming'. And I took that step further when I started creating my own teams and organizations under the Gosu banner.

I would never say I was a pro at any game. But I was so attracted to the idea of it - the promise of entertainment and always found my way around it.

Rohan: That's an exciting journey. You are now the CEO of Unikrn recently had a relaunch a few weeks ago in Canada and Brazil. Under Entain’s ownership, what’s different about Unikrn this time around?

Justin Dellario: First it is important to identify that as part of the Entain group, we are supported by our CEO and who saw a great opportunity for Entain to expand into what is not just functional betting and wagering and adding more customers but where they could evolve their customer base, where there were new forms of interactive entertainment that still played to its strengths. And esports matches with most of that.

So upon entering Entain and thinking about how to build this new esports mission, there was no better choice than to work to acquire Unikrn, to make that a part of this future vision for Entain. So after acquiring Unikrn and getting started on building this new, next chapter for Unikrn, I think what was important was staying true to all of the esports-first products in the previous innovations by the talented people at Unikrn.

A lot of what you would see there today are the products that have been around for quite some time. However, you know what I would say is different about this chapter is that we have the permission to operate in as many places around the world where domestic betting and wagering is possible.

Of course, we are only live today in Canada and Brazil. That's where our focus is. But we intend to over the next several years to reach more of our customers in several places. In addition to focusing solely on licensed betting and wagering operations, we're also thinking about how to also evolve from where esports betting has been and where it is today to continue to educate the safest, best, and more trustworthy-for-customers version of it. And we also think that includes naturally working hand-in-hand with game publishers and tournament operators and how to make that offering better for our customers, but also ensuring integrity and trust are at the center of everything we do.

Rohan: Unikrn's launch came just as we head into 2023. The business mood, even outside of esports, is not the most upbeat. Esports is not as much of a buzzword as it was three to four years ago. What do you think about the esports' industry's growth in the next couple of years?

JD: I think just as it was a few years ago, esports is poised to continue its growth. It just depends on how you are defining that growth. But naturally, in any form of entertainment where consumers are willing to engage, there's an audience. Where there's an audience, there's a business. So from that perspective, you are going to continue seeing esports grow in the form of more diverse games where competition becomes just a celebration of the mainstay games that have been a part of the esports landscape for the last few years.

Esports fans are generally supportive of the inclusion of advertisers in esports especially when they see it as a means of helping to grow esports and as a means of supporting their favorite players.

I think you are going to see more new diverse content formats and delivery of esports competition which will help further fuel that growth. But with that said, I think what's going to be really important in 2023 and for the next few years of esports' growth are the economics and rights size. As a business, esports has been challenged today. It's been challenging for the last several years. But I think it's even more apparent to those making day-to-day decisions for having to grow esports when they are facing some of the macroeconomic conditions that we all expect.

Monetizing viewership

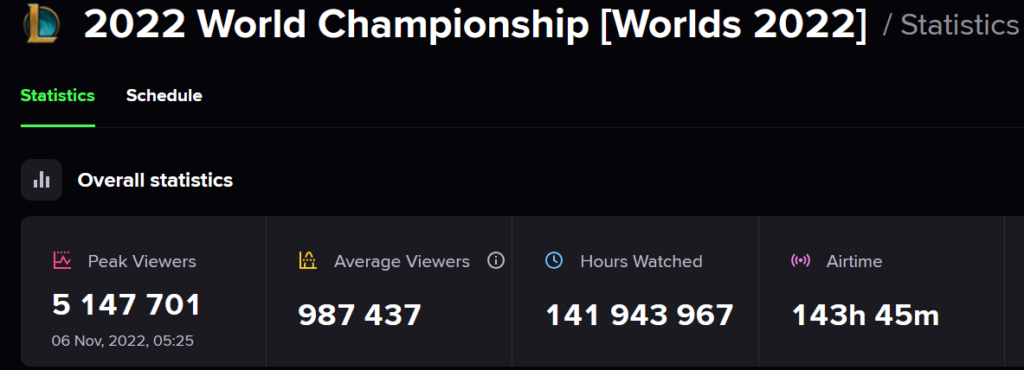

Rohan: Esports has never had a problem getting viewers. But one of the biggest problems in esports is often monetizing these viewership numbers. Fans are used to free content on Twitch, YouTube, free games, etc. What do you think companies could do to secure more revenue and a better return on investments?

JD: Firstly, I'd say a lot of things could be done and I won't pretend to have all the answers on that topic. However, I think we have to first identify what's possible. And to your point from the beginning of what's called the supercharged period for esports growth, the last 5-10 years, you're right, places like Twitch and YouTube are the number 1 places to consume esports. And because of their existence, esports were easily discoverable and have a catalyst to reach more people and have all of these other fans of esports.

But that also meant that from day one, a more traditional media or business model was challenged. Because from day 1 when Twitch and YouTube were the primary places to consume and discover esports, that meant that users were getting all the content for free. This immediately removes from the table, one form of monetization that we know exists in the traditional media or sports landscape.

But beyond strictly the fact that the content is not gated monetarily, we are also dealing with a younger digital gaming audience who's highly opinionated about how they consume media and what formats. There are times when they have been a bit averse to advertisements. That's not a polarizing statement because we also know that esports fans are generally supportive of the inclusion of advertisers in esports. Especially when they see it as a means of helping to grow esports and as a means of supporting their favorite players.

But the idea of a traditional ad break that interrupts exciting gameplay is not popular in esports. So then one more layer of the traditional form of monetization you expect around media is a bit mitigated or challenged. However, then you have traditional sponsorship which is different than media advertising. And to your point earlier, that is where most people are looking for revenue in esports.

Despite the growth of interest in esports by large advertisers and sponsors over the year, a time like the beginning of 2023 when a number of companies around the world are going to be more scrutinizing of their budgets and ensuring whether there's a recession coming or not over this period, some of those budgets might be smaller than they have been previously. This immediately hurts the already challenged industry in the form of monetization.

However, something that's not lacking in esports is the sheer amount of fandom. In industries like sports and traditional media, fandom is monetized in a million different ways that, I would say, the esports industry has not evolved or caught up with yet infrastructurally. In fact, esports betting itself is one of those forms of direct-to-consumer monetization that has a lot of room to grow in esports. Especially when you consider doing it in a safe and trustworthy way, working meaningfully across the industry with all stakeholders to ensure that when money comes out of the pie, it's also returned back to the pie. The infrastructure is aided to grow further.

And then there are a number of other examples like betting and wagering that I would suggest needing to be explored further to make similar mechanisms possible for the benefit of the overall esports economy. But the reality is we are a bit away from that right now. And partly that is due to the fact that people were so overly reliant on sponsorship.

And two, there hasn't been a shortage in the last few years of money from venture capital, independent investors who just knew the sheer amount of fandom has to eventually result in ROI (Return On Investment). So they were investing pretty quickly without a lot of diligence in some cases. And now when faced with tougher-than-usual circumstances in an already challenged business model of esports, that interest is going to dry up for a while.

We also know that esports fans are generally supportive of the inclusion of advertisers in esports. Especially when they see it as a means of helping to grow esports and as a means of supporting their favorite players.

Rohan: Do you think betting operators are going to play a much bigger role 2023 onwards, via sponsorships or otherwise, to help the industry move forward?

JD: I think that it's possible, however, I don't think there's going to be an overnight shift. I think that while the industry faces these tougher economic conditions and looks to right-size the economy of esports, more people will be receptive to the conversation that indicates esports is a meaningful part of direct consumer monetization.

Related articles

It can play a part in right-sizing this economy but I don't think it's going to catch up for the benefit of 2023. Because there's a lot of education to be done around betting and wagering of esports especially as it relates to licenses done safely for consumer betting and wagering.

And that's also going to run up against the fact that the stakeholders across the esports industry which includes game publishers, and tournament organizers - there a lot of different appetites right now to accepting betting and wagering around video games.

Rohan: And it also comes down to regulations. When it comes to esports education, it isn't just about educating people near you, but also about educating people who are totally oblivious to esports, including people in positions of power. You have to explain what esports is from the very basics. Where does that initiative come from? Should it be the game publishers, tournament organizers, or teams? Who is going to 'bear the burden'?

JD: I think in reality it's a mix of all things. If you think about it every stakeholder is impacted whether positively or even logistically. A player passes their rights to a team who passes their rights to a tournament organizer, which is sometimes a publisher and sometimes not. This then allows the organizers of esports competitions to pass data to licensed betting operators so that consumers can bet. So really everybody is involved.

But like in most things in esports, I'd expect the game publishers' sentiment is really going to drive the conversation. And that's a significant number of conversations that Unikrn is having every day with game publishers. We have various numbers of interest and appetite for esports. But we are optimistic that they appreciate how seriously we take customer protection and lawful betting and wagering.

In some cases, that means we are educating them on the difference because they just didn't know there was one between black and gray and white betting operations. It's going to take several months, if not years to make a meaningful change in this industry on the acceptance of betting and wagering.

Diversity of Esports content

Rohan: You mentioned 'hybrid and mixed type of events' as being the future of esports. We recently had the Chess Boxing event which was extremely popular. We've also had many game titles where the publishers have tried to force esports top-down and they've not really taken off at all. Do you think because it's such early days in esports and we have dozens of titles often coming out with their 'esports versions' it's actually hampering the growth and visibility of esports to an investor?

JD: I could definitely appreciate that it is difficult to consider where to invest your money. That's natural because esports as a baseline is already diverse from entertainment has a diverse set of audiences that you can watch and subscribe to. So that's always going to be difficult.

I don't think it's bad for esports. In fact, it only really challenges the 'sports box' that a lot of people want to put around esports. Whereas if you think about this form of entertainment as one available digitally where the intent is really to entertain around competitive video game play, there's a myriad of things available to do that are not necessarily always the most hardcore competition. I think we've seen that over the last handful of years, there've been many different form factors.

Personally, I think I really sort of appreciate the most when the Battle royale games took off and there were a lot of different forms of battle royal competition available. One of the projects I started at Twitch was Twitch Rivals which was one of the hardest esports leagues in the world not focused on the most hardcore competition.

The recent chess boxing event - I think if you are willing to appreciate that this is entertaining content that drives consumer attention, then it's a great thing for this 'video game-digital entertainment genre' that we are all living in.

Rohan: Different games follow different formats and different business models. Dota 2 has a towering TI, CS:GO has an open format, and Valorant and LoL are controlled by Riot. What do you think is the best format out there? And why?

JD: As a hardcore esports fan, I really appreciate the aspects of a few different formats. What Valve does with Dota and CS:GO enables other business stakeholders to exist in and around the space such as ESL, BLAST Pro Series. I also appreciate when a set of esports is hosted by a games publisher, a lot of other fan opportunities become readily available whether that's directly interacting with the game, cross-game commerce, and things you would see around League of Legends as an example. I wouldn't say I have a favorite, but I appreciate aspects of both.

That said, where the esports industry business might be challenged or it would evolve based on the challenges they are facing, I think those different formats for esports require you to think differently and about how to right-size your economics. Because a game publisher can think of their esports as producing an ROI on the basis of creating engagement with their game. Whereas esports tournament operators have to think about the actual content production operation and organization of competition itself as a business and right-size the business according to that.

Justin Dellario's predictions for esports in 2023

Justin Dellario made a few predictions about esports in 2023. They included his thoughts on content diversity, right-sizing budgets, esports adjacent events such as Chess-Boxing, a move to online-only models of tournaments, and more.

Rohan: One of the predictions you made was about esports having a very difficult next 12 months and bloated industry valuations. When we see teams take on more investments over the next year, assuming there are down rounds, how do you think that will reflect on the industry as a whole?

JD: I think you have to recognize that even before anybody started talking about 2022-23 and beyond might be tough to face considering the macroeconomics, the esports team model was already challenged. I think it's the unique aspects of different various formats of esports that we've already mentioned that challenge it as a baseline. Because it's really hard for these esports team brands, in such a short time, to grow enough to have the kind of fan capital that becomes generational that it ensures a long sustainable availability of fans to monetize outside of the competition and whatever events they are trying to compete in.

And that's going by with the fact that they can build an operation with a specific gamer game and then those games might fall out of favor because, in the esports industry, we have so much optionality. Where you've seen teams be successful in producing other revenue and therefore sustainability is the teams that invested in software, influencer-oriented businesses generally.

However, some of those are challenged by the nature of them being an advertising business that's really running like a sponsorship. Sponsorship investors are down across the board, then that's also challenged. But even still, those teams with diverse business models will weather this storm better than anyone. But esports teams generally being challenged is not a good phenomenon. It was in all of the esports landscape and all the challenged business models that would still require years to get it right in my opinion.

Rohan: One of your other predictions was about innovations in the industry and getting back to the online model - saving on expensive travel costs and the like.

JD: I recognize that when we are able to fill large stadiums with audiences in really large and substantial events for players competing in person, that potentially makes the content better, and that has a huge boon for esports. But I don't think that's the only metric or characteristic of esports worth appreciating. Because whether you are filling a stadium with an audience or pointing to the fact that across a significant number of games, the amount of audience connected and subscribed would fill 50 stadiums but you just have to present that viewpoint on esports. They are both equally impressive in my opinion.

I personally, as an esports fan, prefer to sit in a stadium filled with people yelling at the top of their lungs over a bomb plant in Counter-Strike. But as somebody who has been directly involved in the content production of esports, especially at the beginning of COVID, I know that it's possible to hold esports competitions online with teams competing in different places -- in some games, where it's possible to maintain competitive integrity in doing so.

I would expect that if our industry stakeholders such as tournament operators and broadcasters' business models are challenged in the next couple of months, then that's a worthwhile thing to do. Because that's what we want to see - esports survive for the long term and not have too many businesses falter or crash because they felt the need to fill a stadium to be successful in 2023 when economically it does not make sense to do that.

Stay tuned to Esports.gg for the latest news and updates.